Planning your back-to-school shopping in Texas? You’ll want to wait until this specific weekend in August.

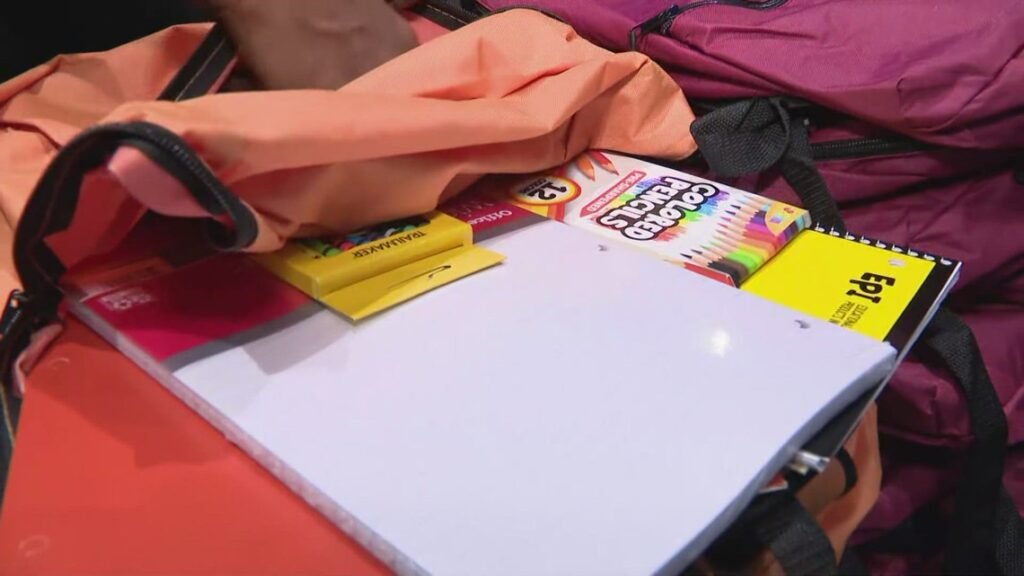

HOUSTON — Texas families can save money on back-to-school purchases during the state’s annual tax-free weekend, which runs from Friday, Aug. 8, 2025, through midnight Sunday, Aug. 10, 2025. The Texas Comptroller’s office announced that qualifying items, including most clothing, footwear, school supplies, and backpacks priced under $100, can be purchased tax-free.

SHARE WITH KHOU 11: Back-to-school survey for parents: What are your questions/concerns?

The sales tax holiday allows shoppers to buy qualifying items tax-free from Texas stores or from online and catalog sellers doing business in Texas. There is no limit on the number of eligible items customers can purchase, and in most cases, buyers do not need to provide an exemption certificate.

“The Comptroller encourages all taxpayers to support Texas businesses while saving money on tax-free purchases,” according to the announcement.

What qualifies for tax-free status

During the three-day period, most shoes, clothes, and school supplies under $100 are exempt from sales tax. Tennis shoes, jogging suits, and swimsuits qualify for the exemption since they can be worn for activities beyond athletics.

Qualifying purchases can be made in-store, online, by mail, or through any other means, as long as the sale occurs during the designated weekend. For online purchases, the transaction date determines eligibility rather than shipping or delivery dates.

Items that don’t qualify

Several categories of items remain subject to sales tax during the holiday weekend. Items priced at $100 or more do not qualify for the exemption, regardless of category.

Specially-designed athletic or protective clothing and footwear are excluded from the tax break. Golf cleats and football pads, for example, don’t qualify because they’re typically worn only for specific sports activities.

Other excluded items include clothing subscription boxes, rental clothing and footwear, alteration services, jewelry, handbags, purses, briefcases, luggage, umbrellas, wallets, watches, computers, software, textbooks, and various types of bags including framed backpacks, athletic bags, and computer bags.

Items used for making or repairing clothing, such as fabric, thread, yarn, and buttons, also don’t qualify for the tax exemption.

Shipping costs affect eligibility

Delivery, shipping, and handling charges can impact whether an item qualifies for the tax exemption. Since these costs are part of the seller’s total price, they may push an item over the $100 threshold.

For instance, a $95 item with a $10 delivery charge would total $105, making it ineligible for the tax exemption.

Refund options available

Customers who accidentally pay sales tax on qualifying items during the holiday weekend can request a refund from the seller. If the seller cannot provide a refund, they can give customers Form 00-985, Assignment to Right to Refund, which allows buyers to file a refund claim directly with the Comptroller’s office.

The sales tax exemption applies only to items purchased during the designated weekend. Items bought before Friday, Aug. 8, or after midnight Sunday, Aug. 10, do not qualify for the exemption, and no tax refunds are available for those purchases.