Single-family home sales soared a whopping 6.8% in May as Houston buyers benefited from lower prices and mortgage rates and higher inventory.

HOUSTON — If you’re looking for a new home, we’ve got great news for buyers and renters! Selling a home? Sorry to be the bearer of bad news.

According to the Houston Association of Realtors, prices are dropping, and housing inventory in May reached its highest level in nearly 13 years.

Homebuyers are seeing lower housing costs due to lower mortgage rates and a slight decline in home prices. The average sales price dropped by 0.7% to $438,230. The median price was down 1.2% to $339,425.

The shift is also benefiting renters.

“With more homes to choose from and prices becoming a bit more favorable, people are definitely feeling more confident and getting back out there,” HAR Chair Shae Cottar with LPT Realty said.

HAR will publish its “May 2025 Rental Home Update” on Wednesday, June 18.

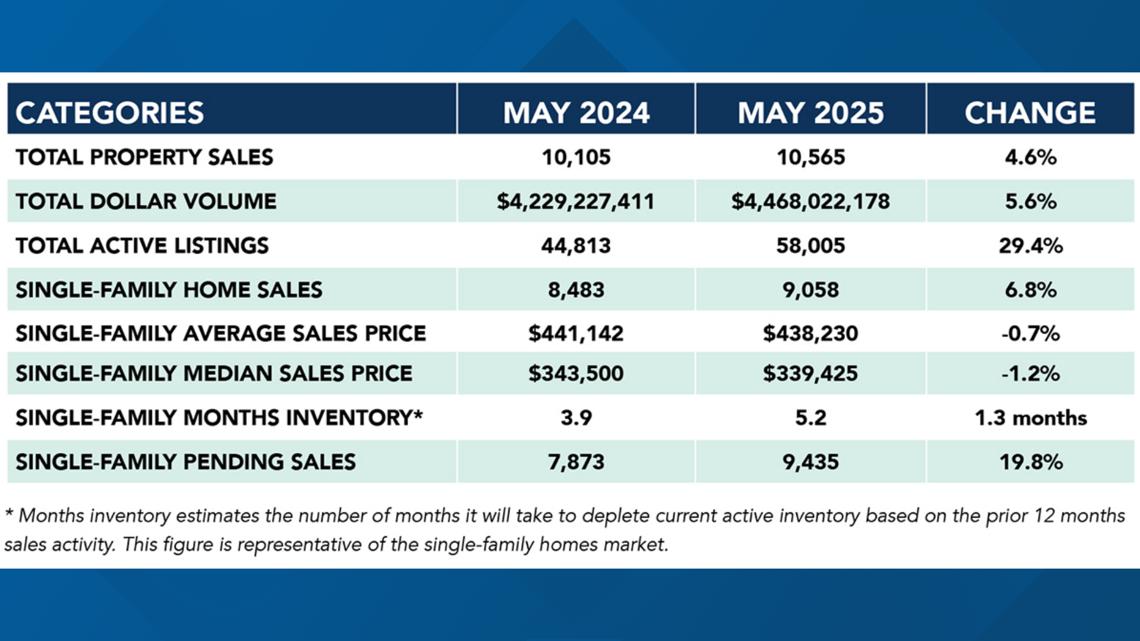

Houston real estate market highlights in May

Here’s a snapshot of May inventory, sales and prices from HAR.

- There were 37,455 active listings of single-family homes, up 35% year-over-year.

- This is the highest volume of active listings since September 2007.

- Single-family home sales increased 6.8% year-over-year

- Days on Market (DOM) for single-family homes went from 46 to 50 days

- The single-family median price declined 1.2% to $339,425

- The single-family average price was down 0.7% to $438,230

- Townhome and condominium sales declined 12.9% year-over-year. The median price declined 8.3% to $221,500, and the average price fell 5.5% to $265,903.

- Total property sales increased 4.6% with 10,565 units sold

- Total dollar volume rose 5.6% to $4.5 billion.

- In May, existing home sales rose 5.1% with 6,370 closings compared to 6,059 last year.

- The average price was statistically flat at $458,299, and the median sales price was unchanged at $345,000.

- Active listings for single-family homes reached 37,455 in May, which is up 35% compared to last May. This volume represents the highest level of active listings since September 2007, when 37,500 units were on the market.

- The rental market also experienced increased demand in May.

Homebuyers cash in on buyers’ market

Houston-area homebuyers are springing into action as expanding inventory and easing home prices create new opportunities across the region. This activity is a clear indicator of the ongoing shift toward a buyer’s market.

Houston’s single-family home sales recorded their largest year-to-date increase in May. According to the Houston Association of Realtors’ May 2025 housing market update, sales rose 6.8% year-over-year, with 9,058 homes sold compared to 8,483 during the same time last year.

“This shift signals to sellers that motivated buyers are engaged and eager to take advantage of the current market conditions,” Cottar said. “We anticipate this momentum will carry us into the summer months.”

Houston-area single-family homes prices, inventory

- May was a strong month for the Greater Houston housing market, as sales rose by a whopping 6.8% compared to the same period last year.

- A total of 9,058 homes were sold versus 8,483 a year ago.

- This positive momentum was mirrored in pending sales, which increased by 19.8% year-over-year.

- Active listings for single-family homes reached 37,455 in May, which is up 35% compared to last May.

- This volume represents the highest level of active listings since September 2007, when 37,500 units were on the market.

- Days on Market, or the actual time it took to sell a home, also increased from 46 to 50 days.

- Months of inventory also rose, climbing from 3.9 months last May to a 5.2-month supply—a level last reached in July 2012. This figure surpasses the national average of 4.4 months as reported by the National Association of Realtors.

Houston townhome and condominium market also favors buyers

Houston’s townhome and condominium market experienced a continued slowdown in May, marking the fourth consecutive month of declining sales.

A total of 485 units were sold, which is a 12.9% decrease from the 557 units sold last May. The average price declined 5.5% to $265,903, while the median price dropped 8.3% to $221,500.

Townhome and condominium listings increased to 3,311, resulting in a 7.8-month supply of inventory. This is a significant jump compared to the 4.6-month supply reported last year at this time. Inventory levels reached their highest point since September 2011, when the supply stood at 8 months.

Affordable housing sales in Houston record biggest increase

Broken out by housing segment, here’s a look at home sales in the Houston area:

- $1 – $99,999: increased 23.8%

- $100,000 – $149,999: increased 18.6%

- $150,000 – $249,999: increased 12.0%

- $250,000 – $499,999: increased 5.7%

- $500,000 – $999,999: increased 0.2%

- $1M and above: increased 6.3%

Lower mortgage rates help save homebuyers money

Freddie Mac’s Primary Mortgage Market Survey

- The average 30-year mortgage rate decreased from 7.06% in May 2024 to 6.82% in May 2025.

- When combined with the dip in median price, buyers’ typical monthly principal and interest mortgage payment fell from $1,839.34 in May 2024 (assuming a 20% down payment) to $1,773.13 as of May 2025, resulting in $66.31 savings per month or $794.36 annually.