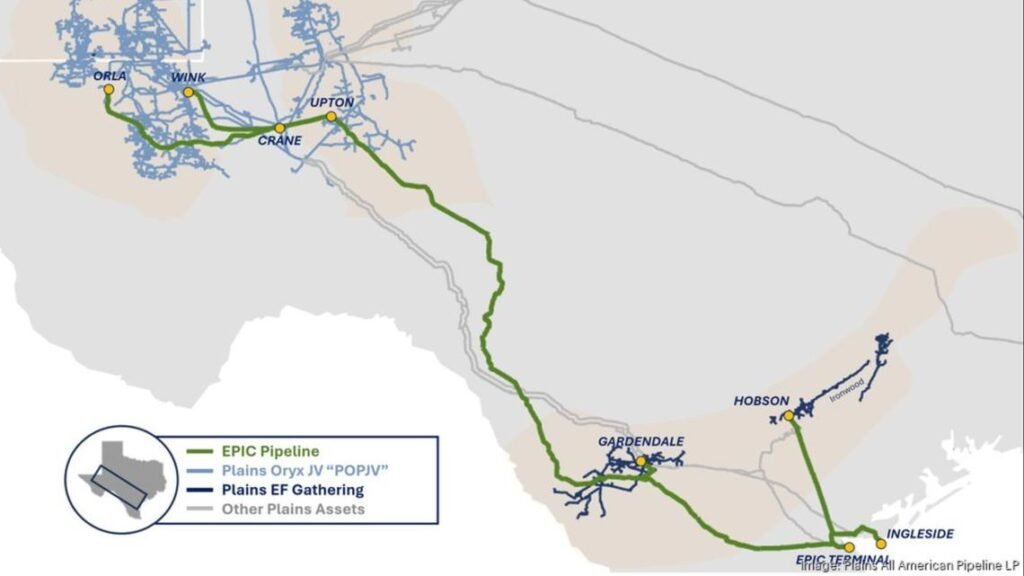

Plains All American is acquiring a 55% stake in EPIC Crude Holdings for $1.57B, boosting pipeline capacity from the Permian and Eagle Ford to Corpus Christi.

HOUSTON — Houston-based Plains All American Pipeline LP (Nasdaq: PAA) — one of the Houston area’s largest publicly traded companies — is buying a major stake in Epic Crude Holdings LP for $1.57 billion, including approximately $600 million of debt.

A wholly owned subsidiary of Plains will acquire a 55% stake in the company, which owns and operates the Epic Crude Oil Pipeline, from subsidiaries of Midland-based Diamondback Energy Inc. (Nasdaq: FANG) and Houston-based Kinetik Holdings Inc. (NYSE: KNTK).

The transaction is expected to be completed by early 2026.

The remaining 45% of Epic Crude Holdings is owned by Epic Midstream Holdings LP, a portfolio company of Ares Management Corp.

Diamondback and Kinetik will each sell their 27.5% stakes in the company for $500 million in net upfront cash and an additional $96 million contingent cash payment due should a capacity expansion of the Epic Crude Oil Pipeline be formally sanctioned by the end of 2027.

Continue reading this story on the Houston Business Journal’s website.

This story came to us through our partnership with the Houston Business Journal. Keep up with the latest Houston business headlines here.

Got a news tip or story idea? Text it to us at 713-526-1111.