Homeowners across Harris County are seeing sharp increases in insurance premiums, with new maps showing ZIP code averages and 8-year trends.

HOUSTON — Homeowners across Harris County are paying significantly more for insurance coverage than just a few years ago — and the increases show no signs of slowing down.

In 2023, the average homeowners insurance premium in Harris County reached $3,325, according to new data from the Texas Department of Insurance, analyzed by the Kinder Institute for Urban Research. That’s a 43% increase — nearly $1,000 more — than in 2015.

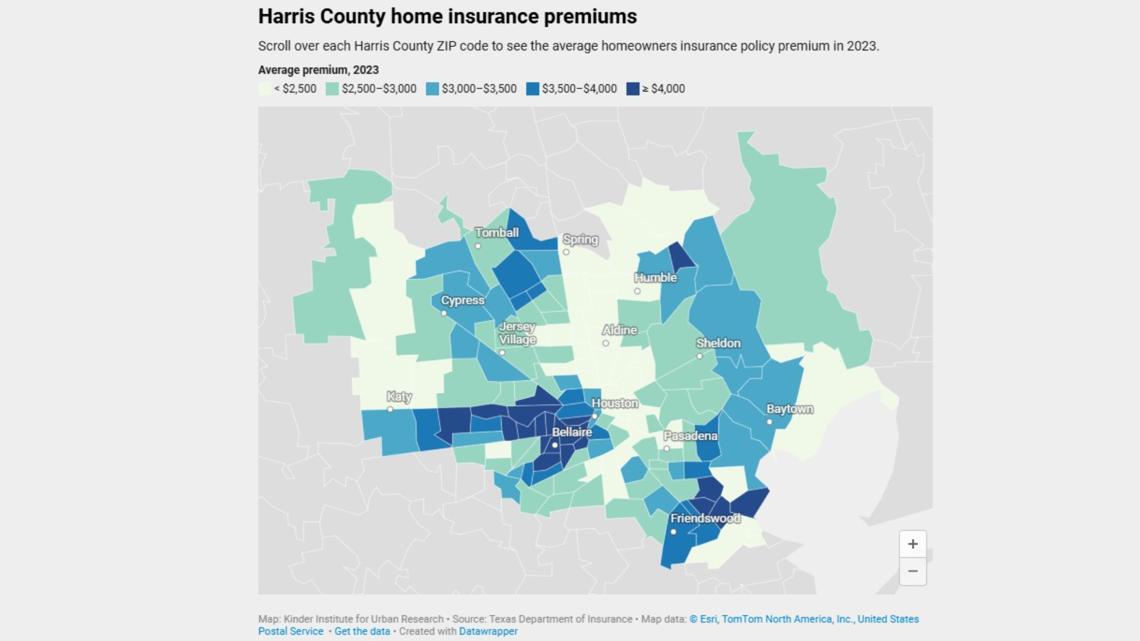

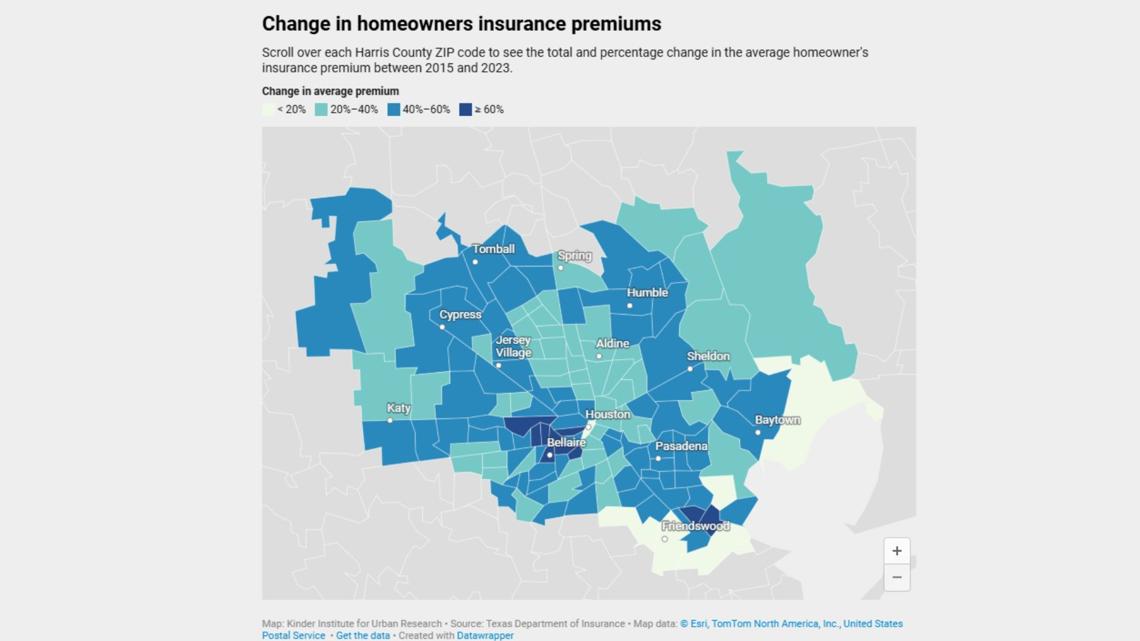

Two maps released by the Kinder Institute — shown below — reveal how average premiums and rate increases vary by ZIP code across the region.

Here’s a map on which you can see county-by-county breakdown how much homeowners are paying in different parts of Harris County.

Why insurance rates are rising

“Home insurance is intended to protect homeowners from risk, but rising costs have made it a growing concern for affordability,” said Aram Yang, a Kinder Institute research analyst.

The price of coverage tends to follow the value of homes. In 2023:

- Wealthier ZIP codes in western Harris County often paid $5,000 to $9,500 per year.

- Many lower-income areas in northeast and southeast Houston still paid under $2,500, though prices have risen everywhere.

From 2015 to 2023, premiums climbed:

- More than 50% in areas like Bellaire, Katy, Tomball, and Friendswood, adding $1,500–$4,000 to annual bills.

- Around 50% in middle-income communities like Baytown, Humble, Sheldon, Cypress, and Pasadena, typically raising costs by $1,000 or more.

- Even lower-income neighborhoods saw hundreds of dollars in increases.

The Texas Department of Insurance says rates jumped another 19% in 2024, yet no legislation was passed this year to curb costs.

Here’s a county-by-county map on which you can see the changes in insurance premiums.

Why people are still buying homes

Despite the higher insurance costs, homeownership in Harris County is growing. According to the Kinder Institute’s 2024 State of Housing report:

- 55% of households in Harris County owned their homes in 2023, up 2 percentage points since 2019.

But that doesn’t mean it’s easy. In a survey of over 5,000 residents:

- Two-thirds said they had at least some difficulty affording housing.

- Among struggling homeowners, nearly 70% blamed rising insurance or flood coverage costs.

No quick fixes on the horizon

While lawmakers introduced bills to increase oversight and fund home hardening upgrades, none passed the full Legislature.

One bill would have allowed greater regulation of insurance rate hikes. Another would have incentivized storm-resistant home improvements. Both passed the Texas Senate but stalled in the House. And homeowners insurance is not on Gov. Greg Abbott’s list of issues for the current special legislative session.

The outlook remains uncertain — but if ocean temperatures continue to rise, the Intergovernmental Panel on Climate Change warns that future hurricanes will become even more powerful. And without meaningful policy intervention, Texans may continue to bear the cost.